From blind spots to bold investment moves

Thurro delivers verified, real-time intelligence for India-focused investors

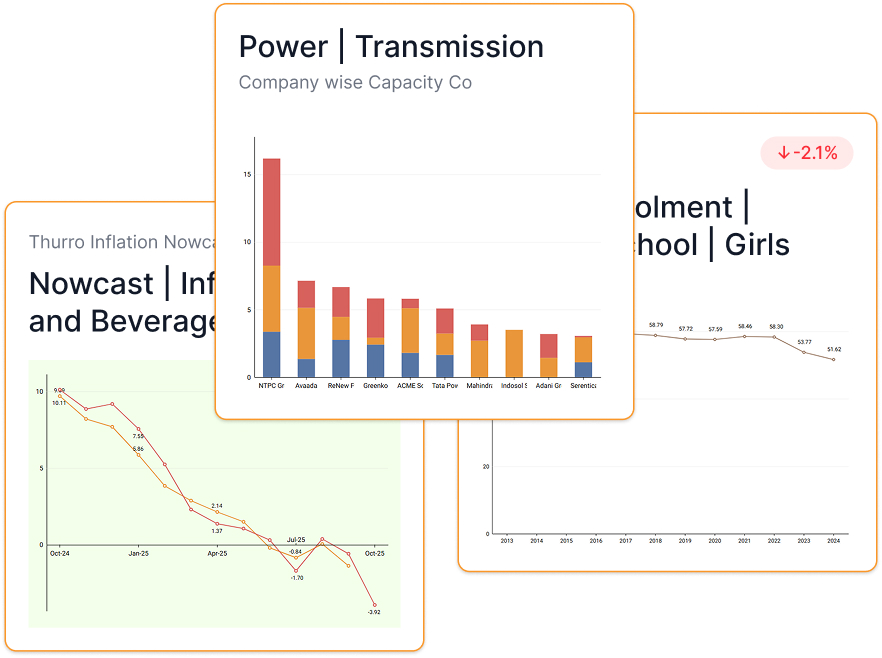

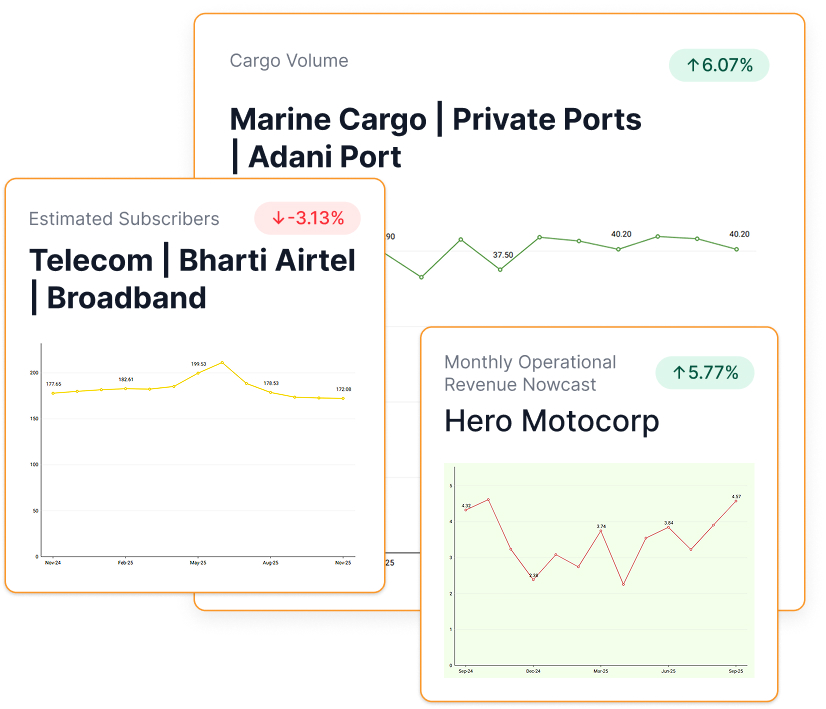

Our core intelligence products

Whether you need quick insights or deep, institutional analysis, Thurro’s three offerings bring structure, accuracy, and scale to every data question

See signals before they become headlines

With Thurro, you don’t just read tomorrow’s news today — you see it before it breaks. From inflation signals to corporate network shifts, our alternative datasets reveal what others miss

Solutions for investment management

Endowment funds

Public market fund managers

Private equity firms